There are different reasons why an EFT/ACH transaction could be rejected or returned from the bank. If an EFT/ACH transaction is returned or rejected, it won’t be processed.

Must know:

- You need to be an administrator of your account or have Full/Read-Only access to Batch Processing.

Why was an EFT/ACH transaction rejected?

- In the Portal, navigate to Processing >

- Batch Processing, OR

- Employee Direct Deposit, OR

- Customer PAD / Vendor DD

- Click the batch you want to review.

- A red X under the ‘Status’ column means there was a return or rejection. Hover over the X to view more information about the error.

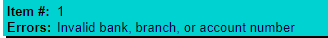

- A pop-up will appear with the reason for the error. ex):

Good to know:

- There is a difference between returns and rejections.

- Returns are due to bank-level errors (e.g. insufficient funds). They can take a few business days or longer to return due to bank processing times so you won’t see the red X right away.

- Rejections are due to bad formatting of bank details, and the red X will usually appear at some point on the process date after 11 am PST.

- If the rejected reason is unclear to you, check the bank information is correct and reach out to the account holder to have them investigate with their bank.

- If the bank information is incorrect, the bank may not find the transaction on their end. To retry the transaction, update the bank information in another batch.

- You’ll only receive an email notification for a return because there’s a fee for returned transactions. No fee is charged for rejections.